Unposting Invoices

Unpost invoices when you need

to reverse the posting of an invoice from the matter billing activity

and your accounts receivable. When you reverse an invoice, the program

removes the posting transaction from the matter billing activity, moves

time tickets from a Billed to an Unbilled

status, and moves costs from a Billed to an Unbilled status.

RECOMMENDATION: It’s better to correct billing activity

on the next invoice – only unpost an invoice if it is absolutely necessary.

Unlike invoices, statements of account cannot be unposted.

Client payments are marked as billed once they have appeared in a statement

of account and can be deleted from the Matter Billing Activity as long

as they have only appeared on one statement of account and have not appeared

on an invoice.

Some things to note about the unposting process:

The invoice is automatically deleted.

When you unpost an invoice and then repost it,

it will get a new invoice number.

You CANNOT unpost an invoice in a fiscal year that

has been closed if you are on an accrual based accounting system.

If you are unposting an invoice where a trust check

has been applied as a client payment, it may result in a credit balance

if fees or costs are changed on that invoice.

When unposting an invoice for a minimum fee matter,

you MUST unpost all invoices PRIOR to the one you need to unpost.

Follow these steps to unpost an invoice:

Select .

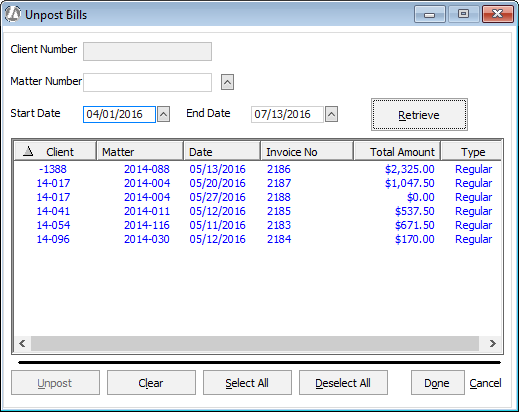

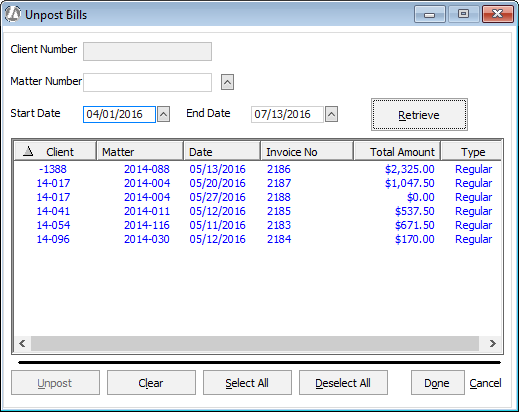

The Unpost Bills window appears. Select a matter

(optional) and change the start date and end date for the invoices

you want to find as necessary. Note that you do not have to select

a matter. You can filter invoices only on the date range if you like.

Click Retrieve for a list

of invoices meeting the search criteria.

Highlight the invoices you want to unpost. You

can click Select All to highlight

all the invoices in the list.

Click Unpost.