Select File > Setup > Client Expense Codes. The Client Expense Codes Browse window appears.

Do one of the following to open the Client Expense Code Maintenance window:

To add a client expense code, click Add.

To edit a client expense code, highlight the code and click Edit.

Complete the settings on the window as

follows:

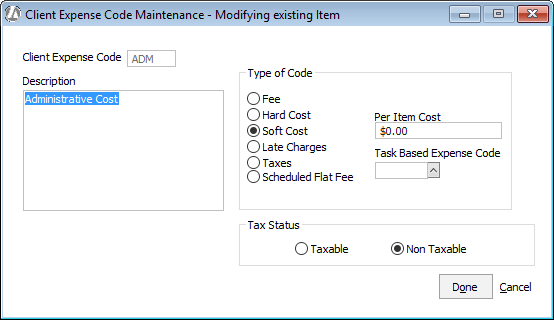

Client Expense Code: Enter up to 3 alphabetic characters and/or digits to uniquely identify this type of client expense.

Description: Enter up to 250 alphabetic characters and/or digits to describe this client expense. This description will be printed on various reports, prebills, and actual bills.

Type of Code: Select the type of client expense.

Letter of Protection: Check this box when the code is for a Letter of Protection (usually used in personal injury suits).

Per Item Cost: Enter the per item charge for soft/hard cost expenses. For example, the per item cost for photocopies might be 25 cents. (This is only a default amount - you can modify this amount when entering costs.)

Task Based Expense Code: [applicable for task based billing only] Select the task based billing code associated with the client expense code.

Tax Status: Specify whether this client expense is taxable or non-taxable. Used to calculate and bill for taxes, when applicable.

Click Done to save your changes.