Select Billing > Costs & Adjustments to open the Costs and Adjustments window.

Click Add. The Costs & Adjustments - Add window opens.

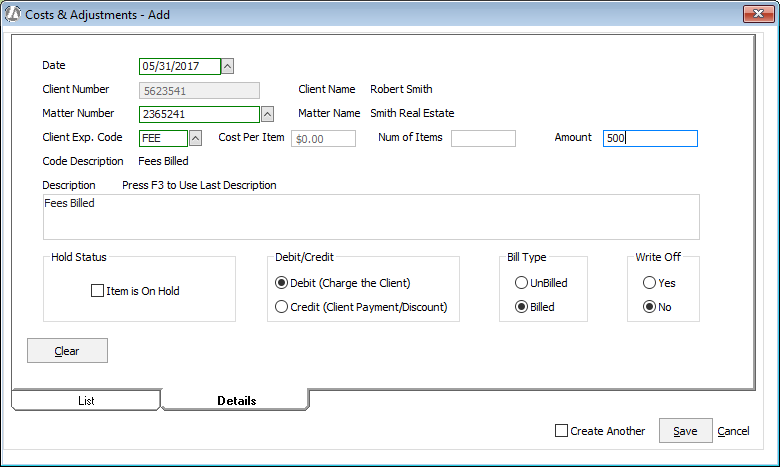

Complete the following settings.

Date: Enter the date of the balance. This is important to enter so that Account Receivables Aging is accurate.

Matter Number: Enter the matter number.

Client Expense Code: When entering the balance, use one of the following four client expense codes: (1) FEE (for the amount of the balance that is for fees billed, but not paid), (2) HCT (for the amount of the balance that is for hard costs billed, but not paid), (3) SCT (for the amount of the balance that is for soft costs billed, but not paid), or (4) LAT (for the amount of the balance that is for late charges billed, but not paid).

Amount: Enter the amount of the balance forward.

Description: Enter a description.

Hold Status: Leave unchecked.

Debit/Credit: Most entries will be a debit, unless for some reason a client has paid more than was billed.

Bill Type: Always set to Billed.

Write Off: Always set to No.

If you want to add beginning balances for other matter account receivables, check Create Another and click Save. The window fields clear and you can enter amounts for the next matter. When you are finished, uncheck Create Another and click Save. The Costs & Adjustments window reappears with your entries listed.

Highlight your entries (click Select All to highlight all entries) and click Post. Your clients now have their beginning balances entered.