Reversing Journal Entries

You have the ability to reverse journal entries in Abacus Accounting. When you reverse an entry, the transaction’s credit and debit accounts are switched. For example, you might want to reverse journal entries if you corrected an entry but realized the adjusting entry was incorrect.

BE CAREFUL when reversing journal entries. Here are some tips to remember:

-

Do not make reversing entries for cash disbursements when a check has been issued. Instead, void the check.

-

Do not make reversing entries for client payments. Instead, add a negative deposit for the client payment. This applies to regular client payments as well as trust deposits.

-

Reversing a journal entry only generates a reversal of the journal entry in the general ledger. Matter Billing Activity and Matter Trust Activity are not affected.

Follow these steps to reverse a journal entry:

-

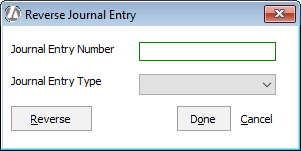

Select G/L > Reverse Journal Entry. The Reverse Journal Entry window appears.

-

In the Journal Entry Number box, enter the number assigned to the journal entry you want to reverse. (You can get the journal number from the Journal Activity window.)

-

In the Journal Entry Type box, select the type of journal entry you are reversing.

-

Click Reverse. The journal entry is reversed in the general ledger with REVERSAL recorded in the entry’s Reference field. The reversing entry is assigned its own journal entry number for the current date.