Bank Reconciliation Troubleshooting

Difference Not Equal to Zero

If all transactions have been cleared and match the bank statement, but Abacus Accounting still reports a difference, do the following:

-

Open the Check Register (G/L > Check Register). Set the end date to the Statement Ending Date set in the Bank Reconciliation window's Account Information tab.

-

If the ending balance on the Check Register does not match the GL Ledger Balance on the Bank Reconciliation window's Account Reconciliation tab, call technical support and ask them to run a General Ledger Summary recalculation.

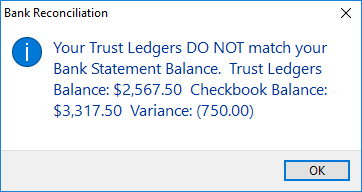

Trust Ledgers Do Not Match Bank Statement Balance

How Trust Reconciliation Works

To understand what this warning means, let's first understand how reconciling trust accounts works in Abacus Accounting.

Trust reconciliation in Abacus Accounting also has to do with the dual ledgers that Abacus keeps to help you manage your trust account:

-

The General Ledger (or Checkbook) is the master record of all transactions on your trust bank account. This should closely match your bank statement. This is what you are viewing when you view the Trust Check Register or the Journal Activity.

-

The Trust Ledger is a separate ledger that associates the trust funds within your trust account with the matters that the money came from. This allows you to keep track of what funds belong to which clients. This is what you are viewing when you view the Matter Trust Activity.

In addition to the standard reconciliation (comparing the G/L to your bank statement), Abacus Accounting performs a secondary reconciliation in the background where it verifies that the total money on all Trust Ledgers matches the total on the General Ledger. This is a safeguard designed to ensure that all money in the trust account is assigned to the client it belongs to, and not unaccounted for (reducing the risk of accidental misuse).

When you see the warning above, this indicates that Abacus Accounting found a variance between the Trust Ledgers and the General Ledger, and that they are, in effect, not reconciled.

How to Fix a Trust Variance

Fixing a trust variance requires determining which transaction(s) appears on only the Trust Ledgers or only on the General Ledger for that trust account. Once you have found the problematic transactions, they will need to be deleted (if possible), or a reversing entry will need to be entered (typically, this involves entering the same transaction again, but with a negative in front of the amount).

The two reports most helpful in determining this are:

-

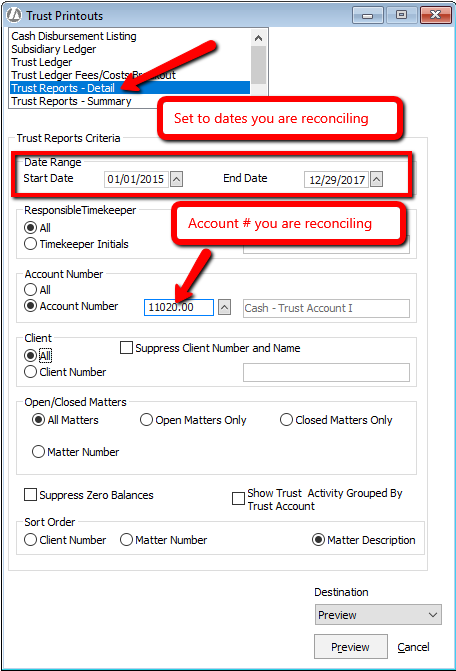

Trust Report – Detail (located under Reports > Trust). This will show the Trust Ledgers transactions.

-

Set the Start Date and End Date to the date range that you are reconciling.

-

Set the Account Number to the number of the trust account you are reconciling.

-

-

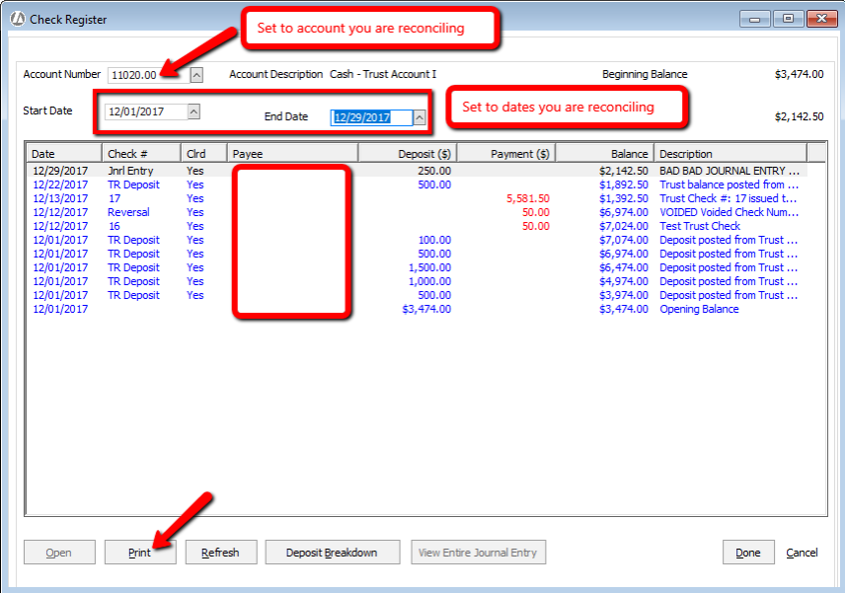

Printout of the Trust Check Register (located under Trust > Trust Check Register, and click Print). This will show the General Ledger transactions.

-

Set the Account Number to the account you are reconciling.

-

Set the Start Date and End Date to the date range that you are reconciling.

-

Two common issues to check for

-

Any directly-entered Journal Entries. These only appear on the General Ledger, typically causing it to become out of the sync with the Trust Ledgers. Check # indicates Journal Entry on the Check Register.

-

Any Trust Adjustments. These only appear on the Trust Ledgers, typically causing them to be out of sync with the General Ledger. Payee indicates Trust Adjustment on the Trust Detail Report.

Further Assistance

-

If a journal entry was entered on trust to account for IOLTA or other trust transactions that don't involve client funds directly, refer to this article for instructions on how to enter this correctly: Handling Interest on Lawyer Trust Accounts.

-

Search this knowledge base, or contact AbacusLaw Client Services at 800-488-3334 if you are not sure how to remove a transaction that you have identified, or re-enter it in the correct way.

-

If you would like assistance reviewing your records to determine the discrepancy, contact our Balance team at 858-795-1794. Note that an hourly fee is charged for this service.