Employer Taxes Journal Entry

Ensure that all appropriate payroll accounts are set up before entering this journal entry.

TIP: Set up a recurring journal entry for this transaction. It could save time since you will be recording the same journal entry for each pay period.

-

Select G/L > Post Journal Entries.

-

The Post General Ledger Journal Entries window appears. Click Add.

-

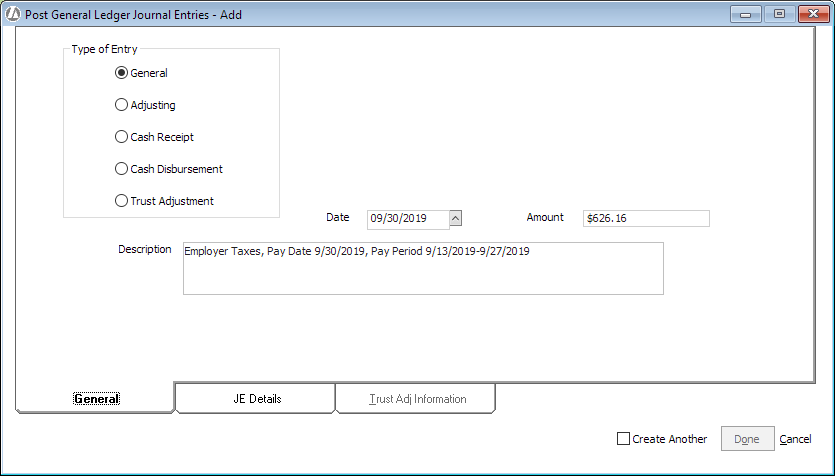

The Post General Ledger Journal Entries - Add window appears. Do the following:

-

Set Type of Entry to General.

-

For Date, enter the date of the payment to the payroll solutions vendor as reflected on the bank statement.

-

For Amount, enter the employer portion of the taxes for the pay period.

-

Include the payment date and pay period in the description. (This will help you search for the transaction later if needed.)

-

-

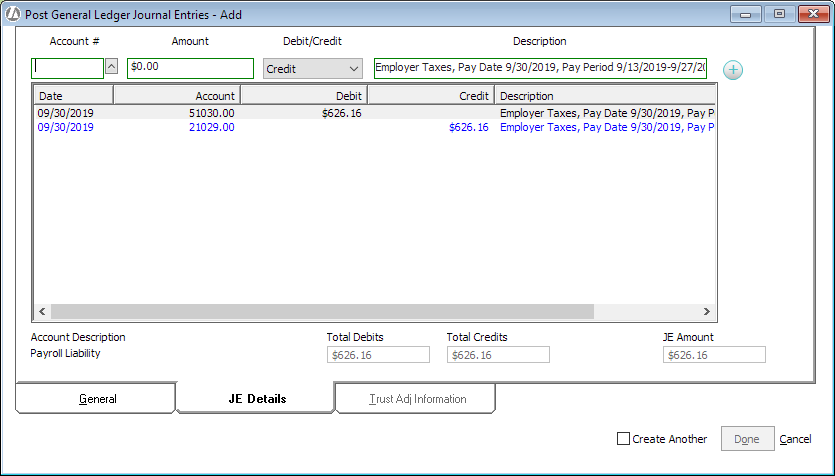

Select the JE Details tab.

-

The debit is recorded against the Payroll Tax Expense account (51030.00).

-

The credit is recorded against the Payroll Liability account (21029.00).

-

-

Click Done to save the transaction.