Select Billing > Costs & Adjustments. The Costs & Adjustments window appears.

Do one of the following:

To add a soft cost or adjustment, click Add or click the Costs toolbar button.

To modify a cost or adjustment, highlight it and click Edit.

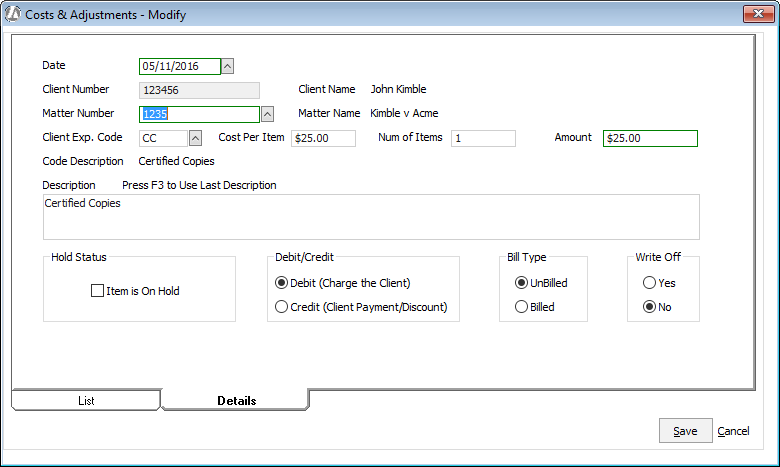

The Costs & Adjustments – Add or

Modify window appears.

Complete the fields on the window as follows:

Matter Number: Select the matter number for the transaction.

Client Exp. Code: Select the client expense code for the transaction. SPD, HPD, and FPD will always be recorded as a credit. FEE should only be used for balance forwards – it will be set to Billed.

Cost Per Item: If the selected client expense code has been set up with a per item cost, this amount will automatically appear.

Date: The current date – change as necessary.

Num of Items: Enter the quantity of items for the cost or adjustment. This field is only used if the client expense code has a cost per item entered.

Amount: Abacus Accounting will automatically fill this field with the product of Num of Items x Cost Per Item – change as necessary.

Description: The preset description from the selected client expense code. You can customize the description for this record if you like.

Hold Status: Select Item is On Hold if you want to place this transaction on hold. Items on hold will appear on the prebill but NOT on the actual bill. For example, you might use this to track your actual costs even though the client might not be paying it.

Debit/Credit: Select the type of transaction. Debit means you are charging the client; credit means a client payment/discount. (Click here for more for more information about debits and credits.)

Bill Type: Indicates the billing status of the transaction, where:

UnBilled means that the transaction HAS NOT appeared on an actual bill that has been posted.

Billed means that the transaction HAS appeared on an actual bill that has been posted.Write Off: Indicates whether the adjustment will appear on the Write Off report.

Click Done to save your changes.