Do one of the following:

From the Online Banking Import window, click Reconcile Account.

To reconcile trust accounts, select Trust > Reconcile Trust Bank Accounts.

To reconcile non-trust accounts, select A/P > Reconcile Operating Bank Accounts or select G/L > Reconcile Bank Accounts.

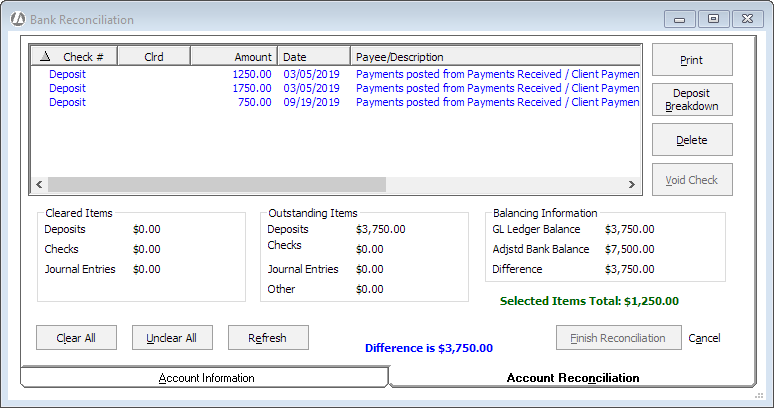

The Bank Reconciliation window appears.

Select the Account Information tab.

Select the Account Number to Balance.

From your bank statement, complete (or confirm since the beginning balance is taken from the ending balance last period) the Statement Ending Date, Beginning Statement Balance, and Ending Statement Balance fields. For the Other Outstanding Transactions field, enter any miscellaneous transactions that affect the adjusted bank balance (for example, deposits that appear on the bank statement, but not Abacus Accounting until next month). This information can be entered and altered at any time during the reconciliation process.

Select the Account

Reconciliation tab. A comparison of the bank statement and

the Abacus Accounting general ledger for the selected time period

appears.

If you want to see detailed deposit breakdown information for a transaction, highlight the transaction and click Deposit Breakdown.

If you need to delete or void a transaction, highlight the transaction and click Delete or Void Check. This lets you clean up the account during the bank reconciliation without having to navigate to a different window.

Click each entry that appears on the bank statement to mark it as cleared. (Each time you click an entry it alternates between cleared and not cleared.) Notice that a “Y” in the Clrd column indicates a cleared entry. If you need more information, check Show Balancing Information for summary information.

When the account is in balance, click Finish Reconciliation and Abacus Accounting will delete all cleared entries. You will be prompted to print the Bank Reconciliation report. You need to print and file a copy of this report.

After the account is reconciled, print and store a copy of the checkbook register. If it is a trust account, print and keep a copy of the Trust Reports – Detail report as well.