Select G/L > Post Journal Entries.

The Post General Ledger Journal Entries window appears. Click Add.

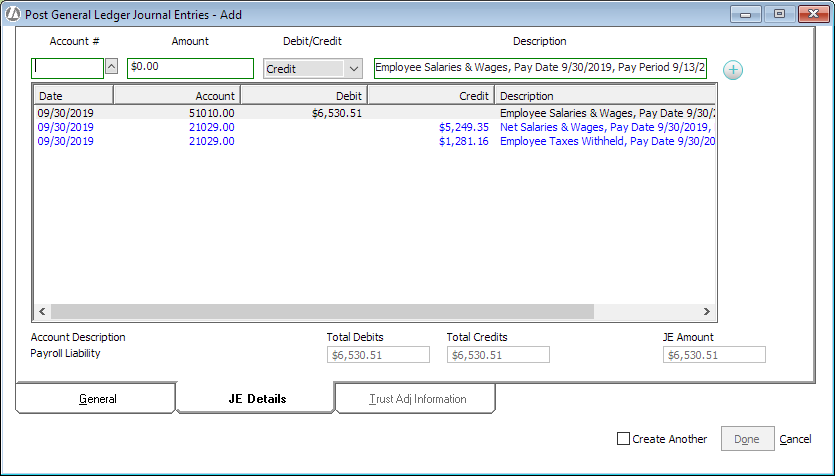

The Post General Ledger Journal Entries - Add window appears. Do the following:

Set Type of Entry to General.

For Date, enter the date of the payment to the payroll solutions vendor as reflected on the bank statement.

For Amount, enter the total of the employee gross salaries and wages for the pay period.

Include the payment date and pay period in the description. (This will help you search for the transaction later if needed.)

Select the JE Details tab.

The debit is the total gross salary and wages. Record that amount against the Salary/Wage Expense account (51010.00).

The first credit is the net payment. Record that amount against the Payroll Liability account (21029.00).

The second credit is the employee taxes withheld. Record that amount against the Payroll Liability account (21029.00).

The third credit (if applicable) is for any money collected from employee paychecks (for example, 401K, health insurance, vision, dental, etc.) that is NOT remitted to the payroll solutions vendor. Record that amount to the corresponding Deductions payable account.

Click Done to save the transaction.