Select G/L > Post Journal Entries.

The Post General Ledger Journal Entries window appears. Click Add.

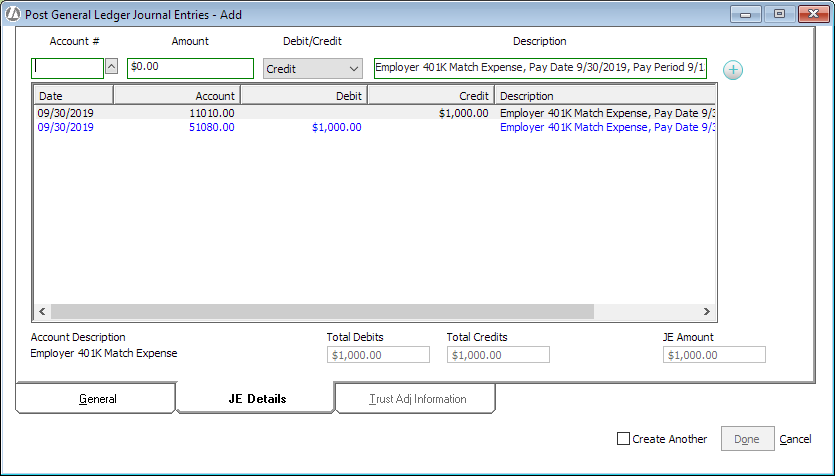

The Post General Ledger Journal Entries - Add window appears. Do the following:

Set Type of Entry to Cash Disbursement.

Ensure that the correct account is selected for Account Number. Use the Payroll Operating account if you use a different operating account to handle payroll. Otherwise, select the Operating account (11010.00).

For Payee, select the 401K retirement provider.

For Date, enter the date of the payment to the payroll solutions vendor as reflected on the bank statement.

For Amount, enter the total 401K match expense for the pay period.

Include the payment date and pay period in the description. (This will help you search for the transaction later if needed.)

Select the JE Details tab.

The credit is automatically recorded against the Payroll Operating account or Operating account (11010.00).

Record the debit against the Employer 401K Match Expense account.

Click Done to save the transaction.