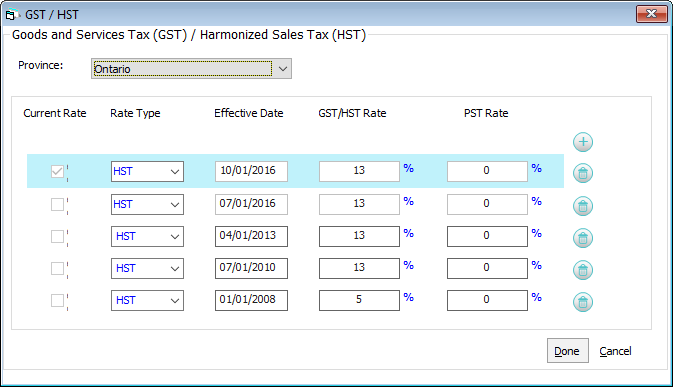

Canadian GST/HST

Goods and Services Tax (GST) and Harmonized Sales Tax (HST)

can be managed using the Canadian

PALS.

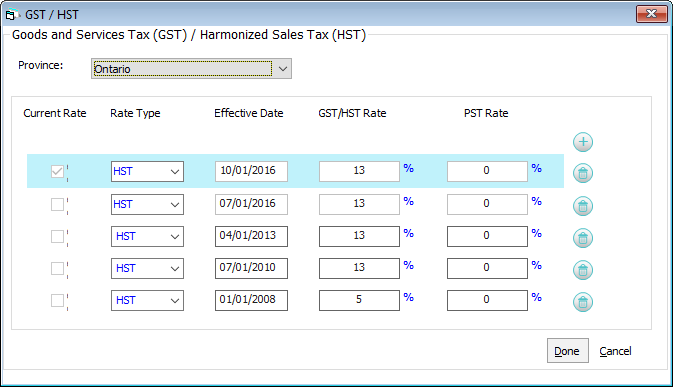

Maintaining GST/HST Tax Rates

Select File

> Setup > Set

GST/HST Tax Rates.

The GST/HST window appears listing all available

tax rates from January 1, 2008 for the selected province. NOTE: Province

defaults to the province you have selected for your tax jurisdiction

in Company Preferences when setting

up the Canadian PALS. Select the appropriate province as necessary.

Do any of the following:

To add a tax, click the Add

button ( ). A new, blank row appears on

the window. Complete the fields for the new tax. Click the Save button (

). A new, blank row appears on

the window. Complete the fields for the new tax. Click the Save button ( )

when finished.

)

when finished.

To edit a tax, change the values in the boxes

as necessary and click Save.

To delete a tax, click the Delete

button ( ) for the row.

) for the row.

Click Done

to save your changes and close the window.

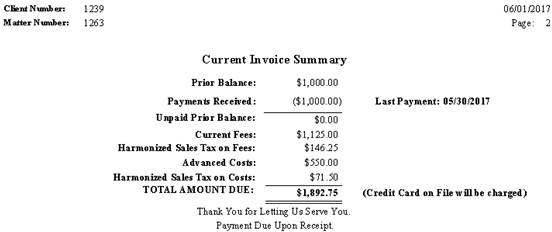

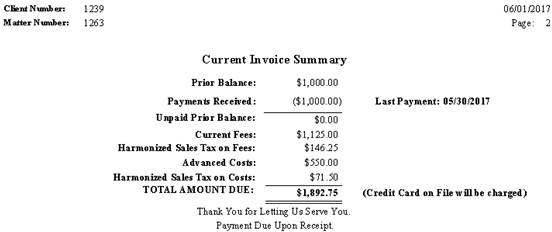

GST/HST Billing

After GST/HST rate maintenance is complete, the amount

of GST/HST and sales tax is calculated during billing based on the rate

effective on the invoice date in the tax jurisdiction for the matter.

If the tax jurisdiction of the client matter follows GST+PST rate type,

the sales tax and GST/HST are calculated separately. Once matters and

the client expense have been set up as taxable, taxes are calculated on

fees and costs at the time of printing bills.

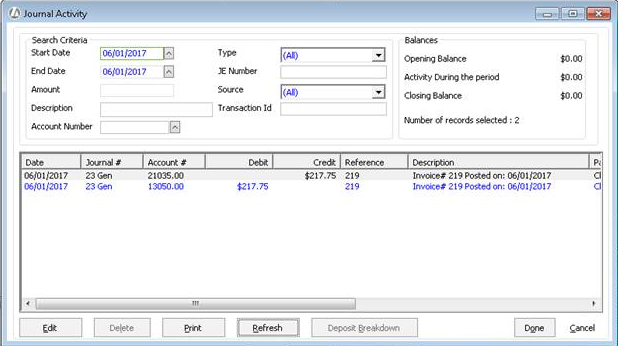

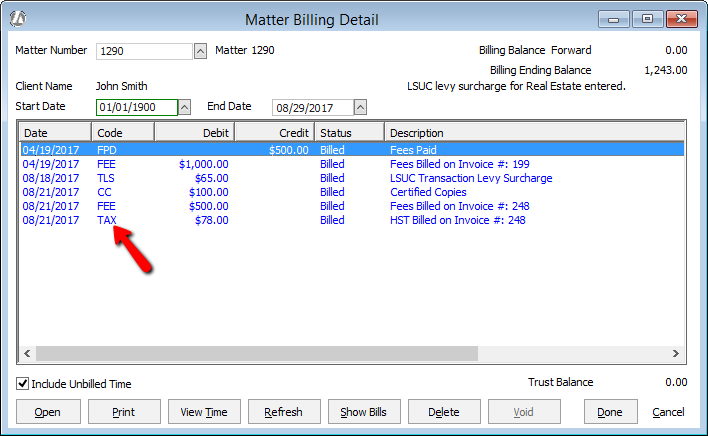

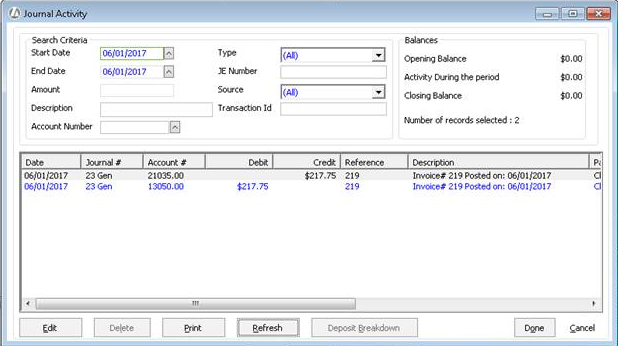

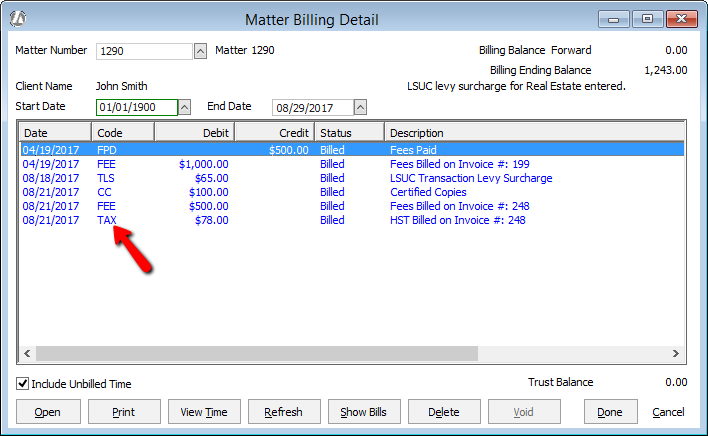

GST/HST Posting

Posting the bill creates a journal entry for GST/HST transactions:

And, an entry for GST/HST in the matter billing activity:

Client Payments/Refunds

When

payment is received for the invoice, the GST/HST Receivable account is

credited and the Operating account is debited. If the client is refunded,

Tax Amount is automatically populated.

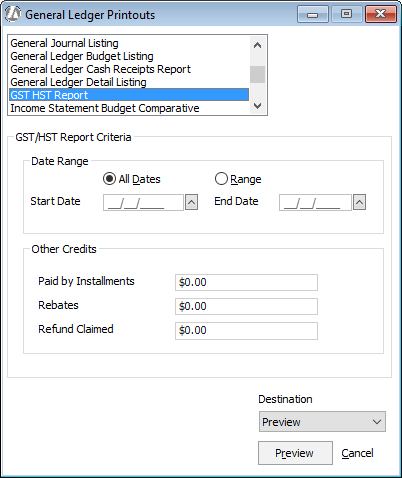

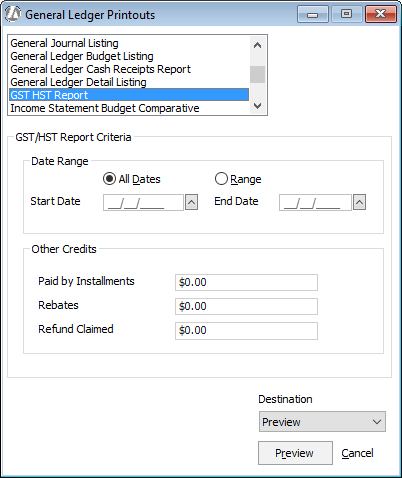

GST/HST Report

The GST/HST report lists the

transactions for Goods and Services Tax (GST) and Harmonized Sales Tax

(HST) for the selected date range.

). A new, blank row appears on

the window. Complete the fields for the new tax. Click the Save button (

). A new, blank row appears on

the window. Complete the fields for the new tax. Click the Save button ( )

when finished.

)

when finished. ) for the row.

) for the row.