Canadian LSO Transaction Levies

Overview

Law Society of Ontario (LSO) transaction levies are payable

by law firms for real estate and civil litigation matters for Ontario,

Canada. This is a one-time fee for each matter. Transaction levies can

be charged to the client at the firm's discretion.

Abacus Accounting has the functionality to maintain the

rates for LSO transaction levies and to track transaction levy surcharges

when using the Canadian PALS.

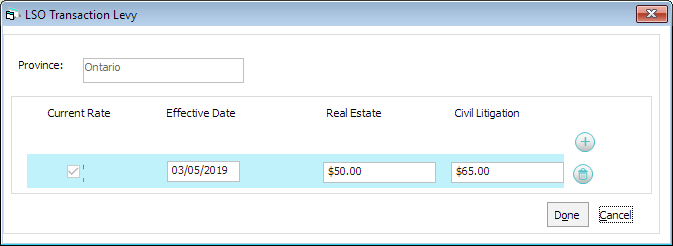

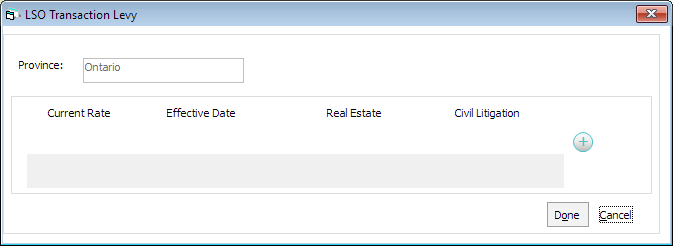

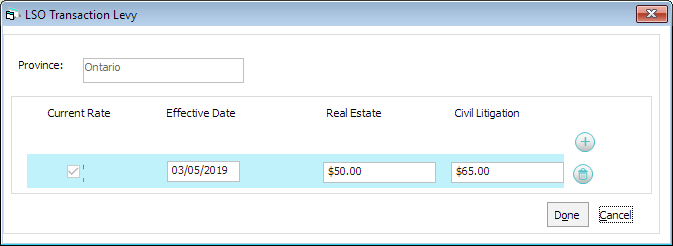

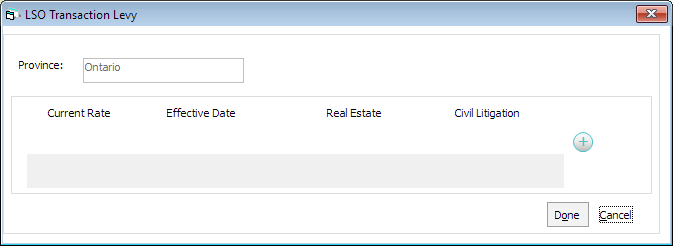

Setting Up LSO Transaction Levies

Select File

> Setup > Set

LSO Transaction Levies.

The LSO Transaction Levy window appears. Click

the Add button ( ) to add a transaction levy.

NOTE: Province defaults to the province you have selected for your

tax jurisdiction in Company Preferences when setting

up the Canadian PALS.

) to add a transaction levy.

NOTE: Province defaults to the province you have selected for your

tax jurisdiction in Company Preferences when setting

up the Canadian PALS.

A new, blank row appears on the window. Complete

the fields for the new transaction levy. Click the Save

button ( ) when finished.

) when finished.

Repeat steps 2 and 3 to add all transaction levies.

Click Done when you are finished.

Maintaining LSO Transaction Levy Surcharges

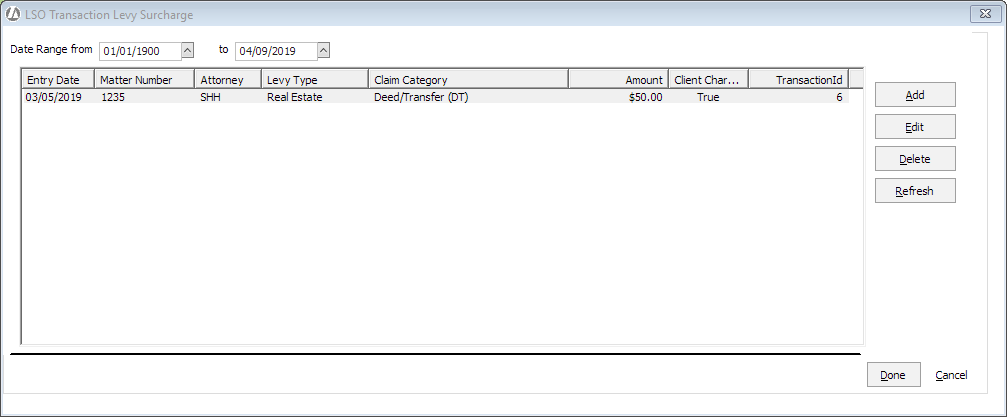

Select G/L

> LSO Transaction Levy Surcharges.

The LSO Transaction Levy Surcharges window appears.

Click Add.

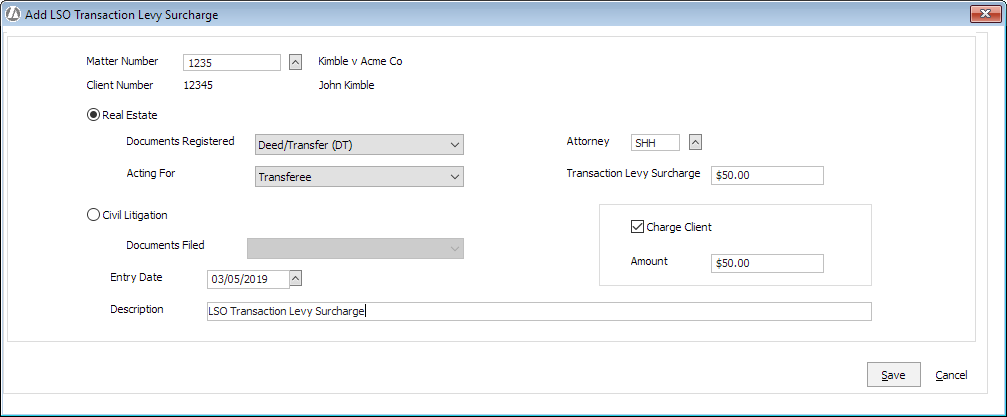

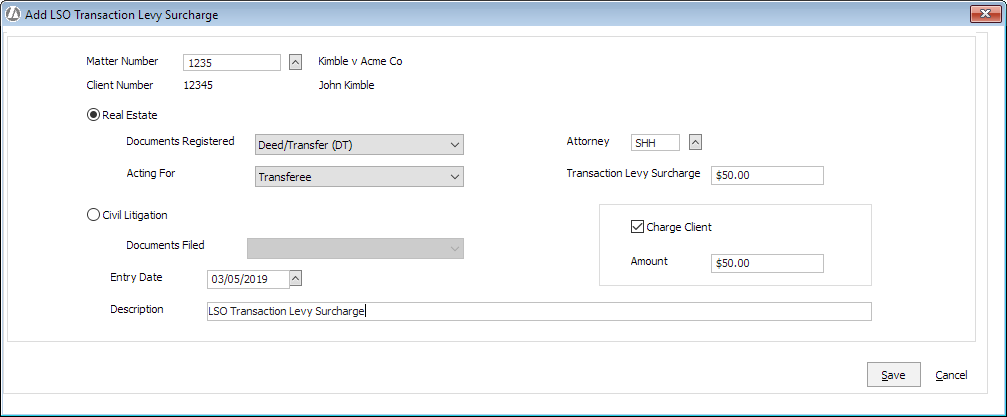

The Add LSO Transaction Levy Surcharge window appears.

Select the matter for the surcharge entry.

Select Real

Estate or Civil Litigation

depending on the type of surcharge you are entering. Then, complete

the fields for the type of charge.

Select an attorney.

The Transaction

Levy Surcharge value is copied from the LSO transaction

levy you set for the effective date.

If you want to charge the client for the levy,

check Charge Client and

the amount in the Transaction

Levy Surcharge field is copied to the amount to charge

the client.

Click Done

to save your changes.

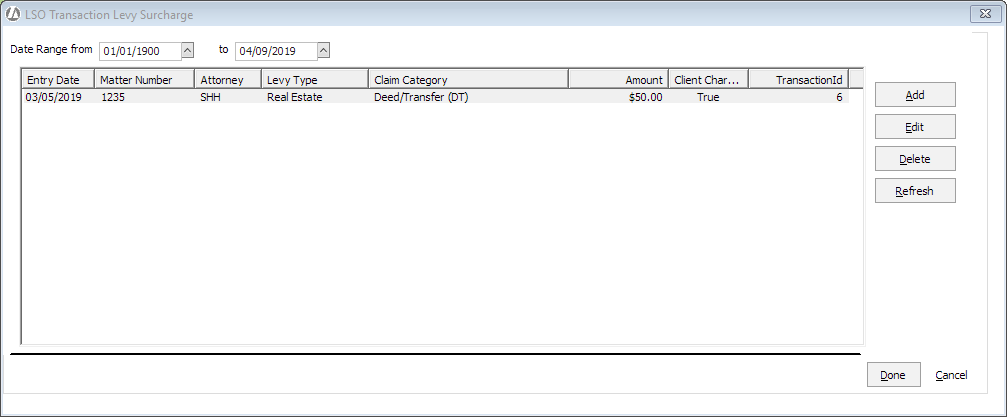

Once saved, entries are listed on the LSO Transaction

Levy Surcharges window. Entries can be modified (highlight the entry

and click Edit) or deleted

(highlight the entry and click Delete).

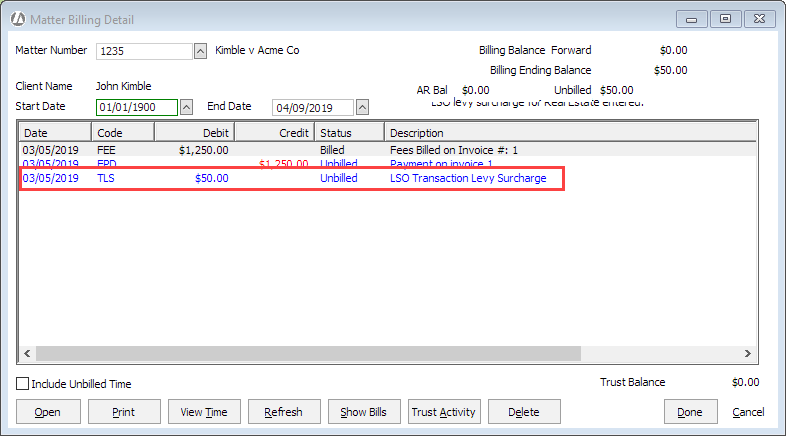

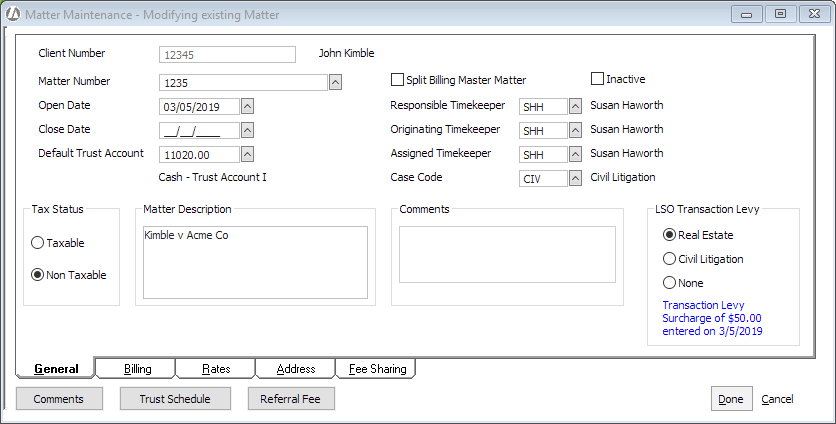

Tracking LSO Transaction Levy Surcharges

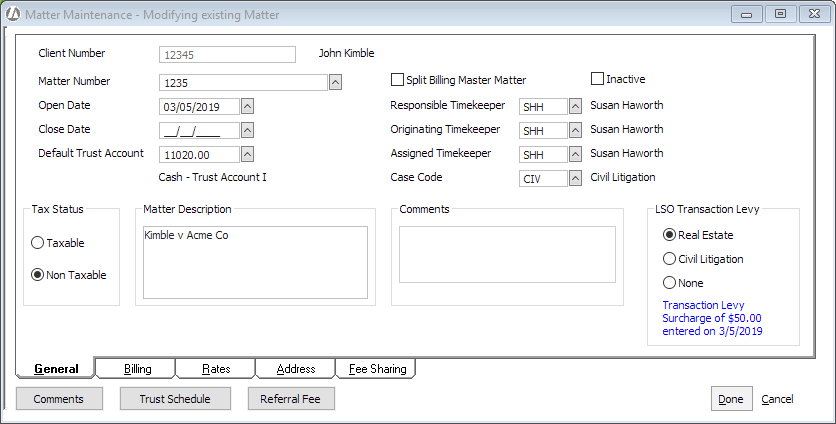

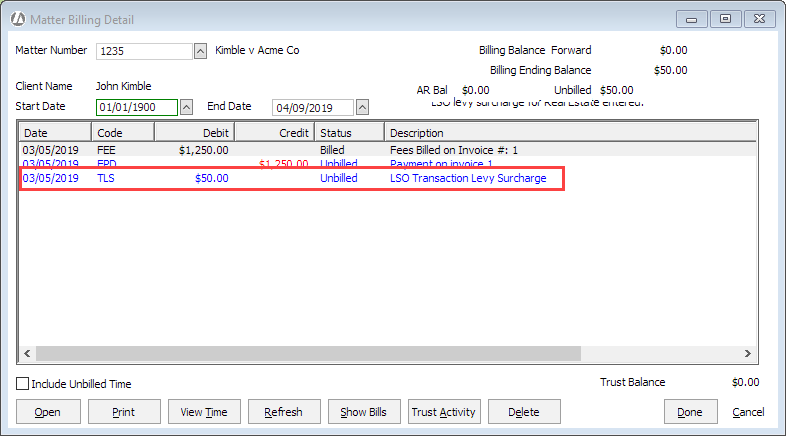

If a LSO transaction levy surcharge has been entered for

a matter, that information will appear on the Matter Maintenance window:

And, on the Matter Billing Detail window:

If the firm selected to charge the client for the LSO transaction

levies, then a record is created for the matter, and it will appear in

the Costs & Adjustments window. This record is assigned the client

expense code you created for LSO transaction levy surcharges, and it will

be available to be billed.

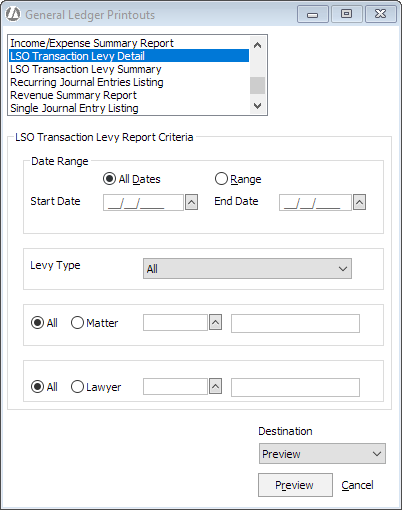

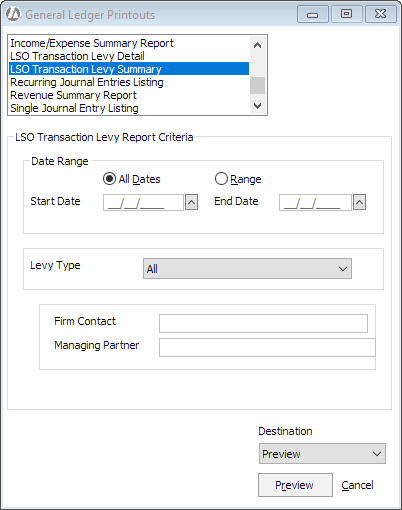

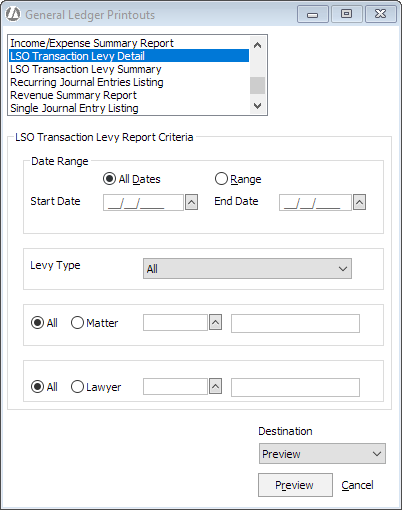

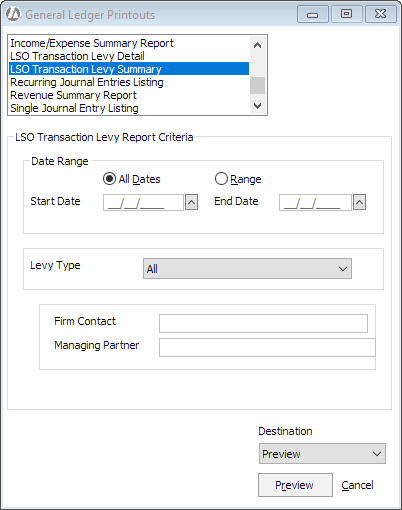

LSO Transaction Levy Surcharge Reports

There are two LSO transaction levy surcharge reports available

under General Ledger reports: LSO Transaction Levy Detail and LSO Transaction

Levy Summary. These reports list the LSO transaction levy surcharges entered.

Both reports can be filtered by date range and levy type. The Detail report

can be further filtered by matter or attorney. The Summary report includes

required fields Firm Contact and

Managing Partner.

) to add a transaction levy.

NOTE: Province defaults to the province you have selected for your

tax jurisdiction in Company Preferences when setting

up the Canadian PALS.

) to add a transaction levy.

NOTE: Province defaults to the province you have selected for your

tax jurisdiction in Company Preferences when setting

up the Canadian PALS.

) when finished.

) when finished.