Generating 1099/1096 Reports

Click here

for a summary of 1099/1096 reports.

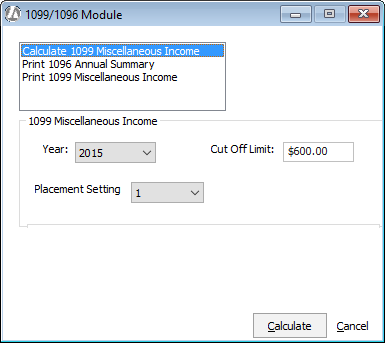

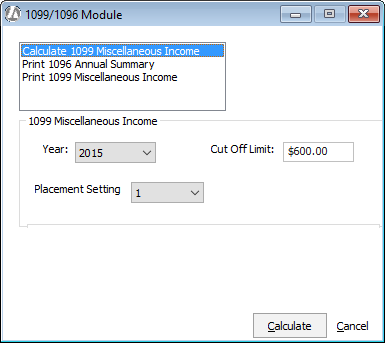

Step 1: Calculation

Before you can print the 1099 and 1096 forms, you need

to calculate the relevant fields.

Select

.

The 1099/1096 Module window appears.

Highlight Calculate

1099 Miscellaneous Income.

Select the year for the reports.

For

Cut Off Limit,

enter the minimum annual payment amount for vendors to be included

in the reports. The reports will not calculate/include vendors that

have been paid less than the Cut Off Limit for the selected year.

If

you will be using your own pre-printed, blank 1099/1096 forms, for

Placement Setting enter

the line adjustment for the 1099/1096 forms. (If you want to use the

build-in electronic form, this field is not applicable.)

Click Calculate.

This calculates all 1099/1096 fields for vendors. The following calculations

are made for the report:

Payments to the vendor are calculated

as Paid to Attorney if Vendor

is providing legal services is checked in the vendor's

account information.

Payments are calculated as Rent Paid

if Rent Account is checked

in the expense

account's settings.

All other payments are calculated

as Non-Employee Compensation.

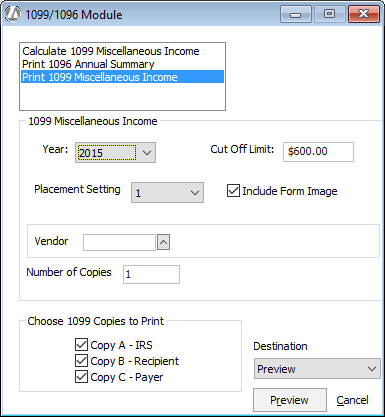

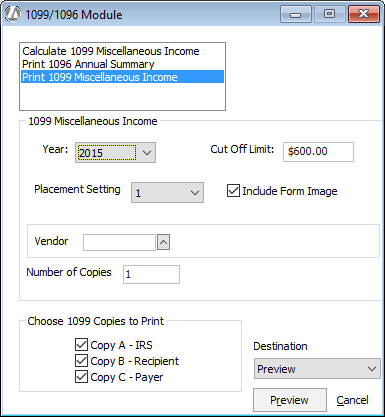

Step 2: 1099 Forms

Once the 1099 fields are calculated and any adjustments

are made to the vendor values, you can print the 1099 forms.

Highlight Print

1099 Miscellaneous Income.

If you would like to use the built-in

1099 form, check Include Form Image.

If you are going to pint field values on a pre-printed 1099 form,

do not check Include Form Image.

NOTE: You can purchase these forms from Safeguard Business Systems

(1-800-432-7701).

Select the vendor for the form. Leave

this field blank to generate for all 1099 vendors. If printing for

all vendors, two vendors will be printed per page.

Enter the number of copies you want to

print.

If you checked Include

Form Image, check the copies of the form you want to print.

Under Destination,

select whether you want to preview or print the report or print the

report to a file.

Click Preview,

Print, or File

(depending on what you chose for print destination). REMEMBER: If

you did not check Include Form Image,

then you need to load the printer with the appropriate pre-printed,

blank 1099 forms.

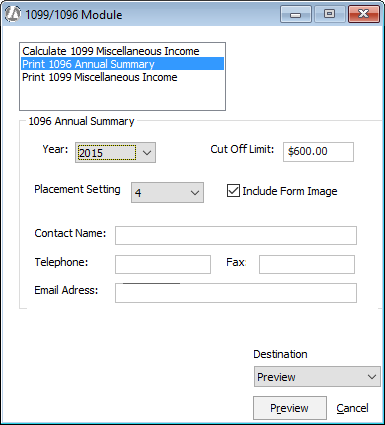

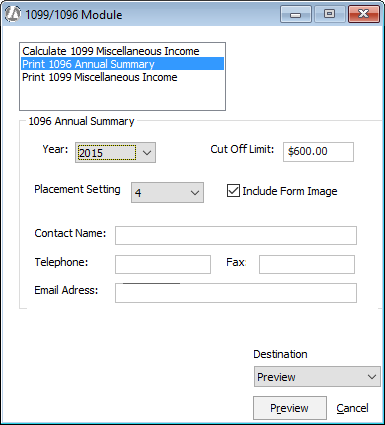

Step 3: Print 1096 Forms

After printing the 1099 forms, you can run the 1096 forms.

NOTE: You must print all 1099 forms before the 1096 Annual

Summary can be printed.

Highlight Print

1096 Annual Summary.

If you would like to use the built-in

1096 form, check Include Form Image.

If you are going to pint field values on a pre-printed 1096 form,

do not check Include Form Image.

NOTE: You can purchase these forms from Safeguard Business Systems

(1-800-432-7701).

Enter the contact information for the

form.

Under Destination,

select whether you want to preview or print the report or print the

report to a file.

Click Preview, Print,

or File (depending on what

you chose for print destination). REMEMBER: If you did not check Include Form Image, then you need

to load the printer with the appropriate pre-printed, blank 1096 form.