Generating 1099/1096 Reports

Click here for a summary of 1099/1096 reports.

To generate 1099 reports

-

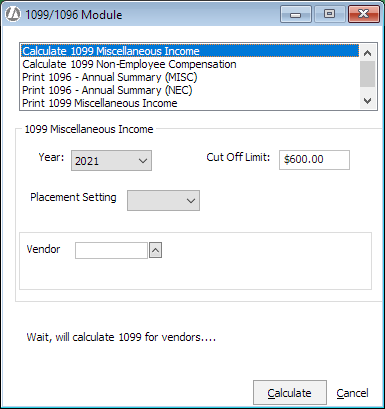

Select Reports > 1099 and 1096. The 1099/1096 Module window appears.

-

Highlight Calculate 1099 Miscellaneous Income or Calculate 1099 Non-Employee Compensation, depending on which report you want to generate.

-

Select the year for the reports.

-

For Cut Off Limit, enter the minimum annual payment amount for vendors to be included in the reports. The reports will not calculate/include vendors that have been paid less than the Cut Off Limit for the selected year.

-

For Vendor, select the vendor for the form. Leave this field blank to generate for all 1099 vendors.

-

Click Calculate. This calculates all 1099 fields for vendors. The following calculations are made:

-

Payments to the vendor are calculated as Paid to Attorney if Vendor is providing legal services is checked in the vendor's account information.

-

Payments are calculated as Rent Paid if Rent Account is checked in the expense account's settings.

-

All other payments are calculated.

-

-

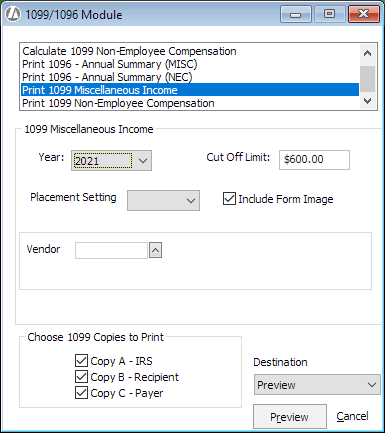

Highlight Print 1099 Miscellaneous Income or Print 1099 Non-Employee Compensation, depending on which report you want to print.

-

If you will be using your own pre-printed, blank 1099 forms, for Placement Setting enter the line adjustment for the 1099 forms. (If you want to use the built-in electronic form, this field is not applicable.)

-

If you would like to use the built-in 1099 form, check Include Form Image.

-

For Vendor, select the vendor for the form. Leave this field blank to generate for all 1099 vendors. If printing for all vendors, two vendors will be printed per page.

-

If you checked Include Form Image, check the copies of the form you want to print.

-

Under Destination, select whether you want to preview or print the report or print the report to a file.

-

Click Preview, Print, or File (depending on what you chose for print destination). REMEMBER: If you did not check Include Form Image, then you need to load the printer with the appropriate pre-printed, blank 1099 forms.

To generate 1096 reports

IMPORTANT: You must print all 1099 forms before the 1096 forms can be printed.

-

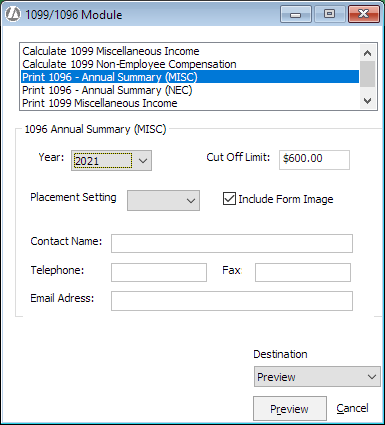

Select Reports > 1099 and 1096. The 1099/1096 Module window appears.

-

Highlight Print 1096 - Annual Summary (MISC) or Print 1096 - Annual Summary (NEC), depending on which report you want to print.

-

Select the year for the reports.

-

For Cut Off Limit, enter the minimum annual payment amount for vendors to be included in the reports. The reports will not calculate/include vendors that have been paid less than the Cut Off Limit for the selected year.

-

If you will be using your own pre-printed, blank 1096 forms, for Placement Setting enter the line adjustment for the 1096 forms. (If you want to use the built-in electronic form, this field is not applicable.)

-

If you would like to use the built-in 1096 form, check Include Form Image.

-

Enter the contact information for the form.

-

Under Destination, select whether you want to preview or print the report or print the report to a file.

-

Click Preview, Print, or File (depending on what you chose for print destination). REMEMBER: If you did not check Include Form Image, then you need to load the printer with the appropriate pre-printed, blank 1096 form.