Editing Vendors

NOTE: You can only edit a name with a class of VENDOR in Abacus Accounting.

-

Select File > Setup > Vendors. The Vendors Browse window appears.

-

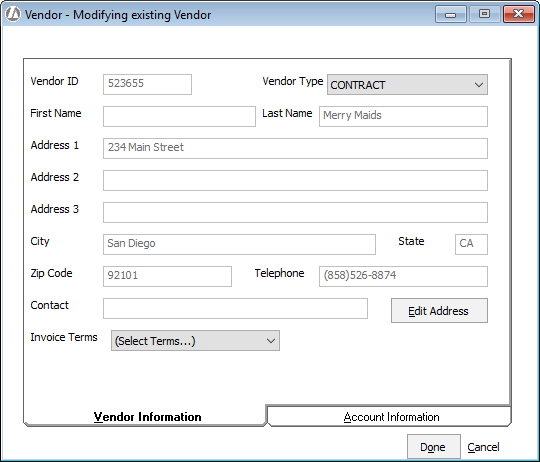

Highlight the vendor and click Edit. The Vendor – Modify existing Vendor window appears.

-

Name and address information is listed on the Vendor Information tab. To edit, click Edit Address. AbacusLaw opens with the vendor selected where you can edit and save the information.

-

Set Vendor Type to assign a vendor type to the vendor.

-

Set Invoice Terms to the vendor’s specific time period for invoice payment (net 15, net 30, etc.).

-

-

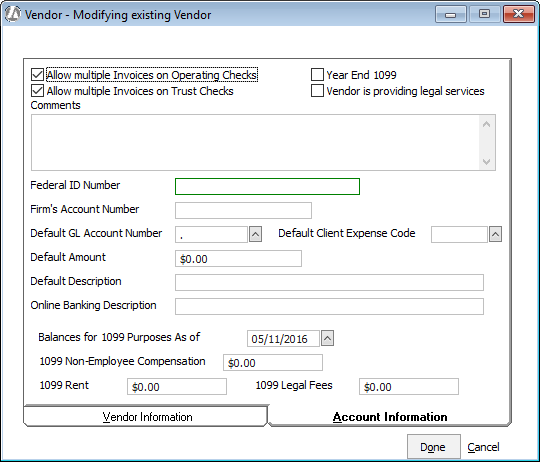

Select the Account Information tab. This tab describes how to integrate the vendor information into the general ledger. This information will default when writing check to vendors.

-

Complete/edit the setting on the tab as follows:

-

Allow multiple Invoices on Operating Checks: Check to combine payments for multiple invoices from this vendor on the same check.

-

Allow multiple Invoices on Trust Checks: Check to combine payments for multiple invoices from this vendor on the same trust check.

-

Year End 1099: Check if you need to generate a Form 1099 for this vendor at the end of the year.

-

Vendor is providing legal services: Check if the vendor is providing legal services. This changes how vendor payments are categorized on the 1099 report (1099 Legal Fees instead of 1099 Non-Employee Compensation).

-

Comments: Enter up to 40 alphabetic characters. This is for informational purposes only; it will NOT appear on the vendor’s checks.

-

Federal ID Number: Enter the vendor’s federal ID number or social security number. This is used for 1099s.

-

Firm’s Account Number: Enter up to 20 alphanumeric characters to identify the account number assigned to your firm by this vendor. This account number will be printed on the vendor’s check stubs.

-

Default GL Account Number: Select the general ledger expense account number to which incurred expenses from this vendor are to be posted.

-

Default Client Expense Code: Select the client expense code most likely to be associated with expenses from this vendor.

-

Default Amount: Enter the default amount that you want on the vendor’s checks.

-

Default Description: Enter the default description you want to appear on the vendor’s checks and your general ledger.

-

Online Banking Description: Enter the default description you want to appear for online banking transactions (like debit card transactions) for this vendor.

-

Balances for 1099 Purposes As of: The date to begin the balances forward and the amount of the balances forward (1099 Non-Employee Compensation, 1099 Rent, and 1099 Legal Fees) for this vendor for 1099 purposes. These balances will be used when 1099s are generated. The amount in these fields will be added to the amount of invoices actually paid in the year the 1099 is generated for. IMPORTANT: You need to calculate the 1099 vendor fields to populate these fields.

-

1099 Non-Employee Compensation : Amount to appear in Nonemployee compensation on the 1099. Any payments made toward an expense account not set as Rent Account will be added to this category when 1099 income is calculated. If Vendor is providing legal services is checked, payments are instead allocated to 1099 Legal Fees.

-

1099 Rent: Amount to appear in Rents on the 1099. Mark your rent expense account as a Rent Account in the Chart of Accounts so that rent payments are added to this category.

-

1099 Legal Fees: Amount to appear in gross proceeds paid to an attorney on the 1099. All non-rent payments will be added to this category if Vendor providing legal services is checked.

-

-

Click Done to save your changes.