Do one of the following:

Select Billing > Payments Received. The Enter Client Payments window appears. Click Add.

Click the Enter Client Payments toolbar button.

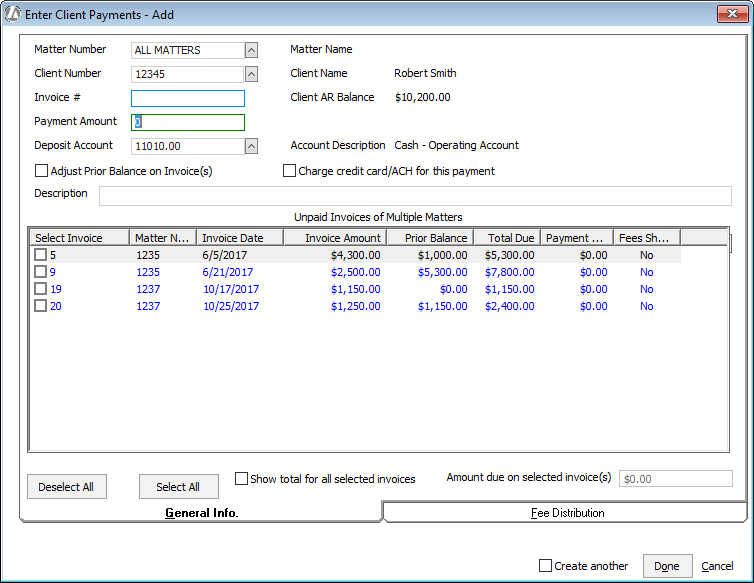

The Enter Client Payments - Add window opens. Leave

Matter Number set to ALL MATTERS and select the client

for Client Number. All unpaid

invoices for the selected client belonging to multiple matters of

the client are listed in the Unpaid

Invoices section. Note that Client

AR Balance is the amount that has been billed

to the client but not paid.

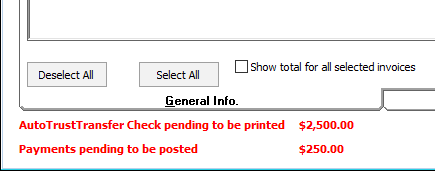

After the client is selected, make note of any

warnings that might be listed in the lower left corner of the window.

You might need to cancel this transaction and correct for the warning.

Warnings will appear if there are any auto trust transfer checks pending

to be printed for the selected client or if there are any pending

client payments pending to be posted for the selected client.

Leave Invoice # blank.

Enter the amount of the client payment in the Payment Amount field. (If this is a negative client payment, enter a minus sign in front of the amount.)

Enter the account number to which the payment is to be applied in the Deposit Account field. (Never use the trust account number!)

When Adjust Prior Balance on Invoice(s) is checked, payments will be applied to invoices’ prior balance first, in first-in, first-out (FIFO) order. When not checked, payments will be applied to the current invoice, and users will have to select more invoices if the payment is greater than the invoice’s balance. NOTE: This option is checked by default if Apply Payments against Prior Balance first is checked in Company Preferences.

Check Charge credit card/ACH for this payment to make the client payment using the credit card or ACH account added for the client. If a credit card/ACH account has not been set up for the client, a form appears and you can set up payment information for the client.

Enter the description of the client payment in the Description field.

The Unpaid

Invoices section lists all unpaid invoices for the selected

client. Unpaid invoices are listed in the order of invoice date, from

the oldest (top of list) to newest (bottom of list). You must check

one of these line items in this section. Notice that when you check

one of these line items, payment breakout information appears on the

right side of the window.

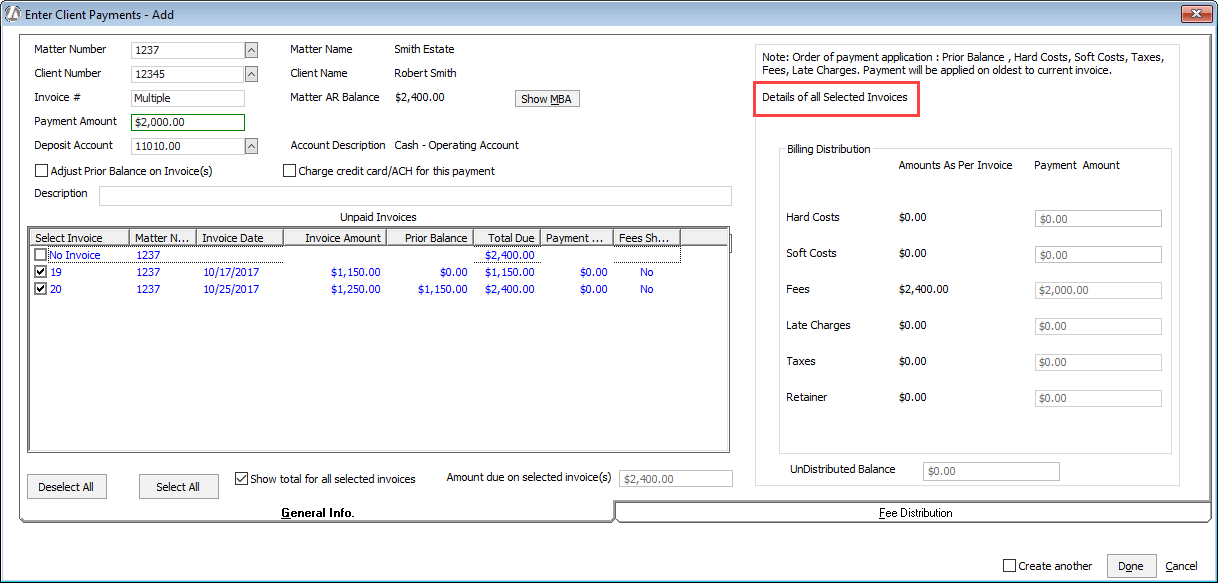

The payment is broken out based on your initial selection of invoices,

starting with the oldest invoice and going in the order of Hard Costs,

Soft Costs, Taxes, Fees, Retainers and Late Charges. If you deselect

an invoice and select another invoice, the payment is not distributed

again by Abacus Accounting. You are responsible for making the appropriate

changes. However, you can deselect all invoices and then select the

correct invoices for payment, and the application will distribute

payment again.

Check the invoices to apply the payment. The payment breakout shows

that the payment is applied to the total of the checked invoices.

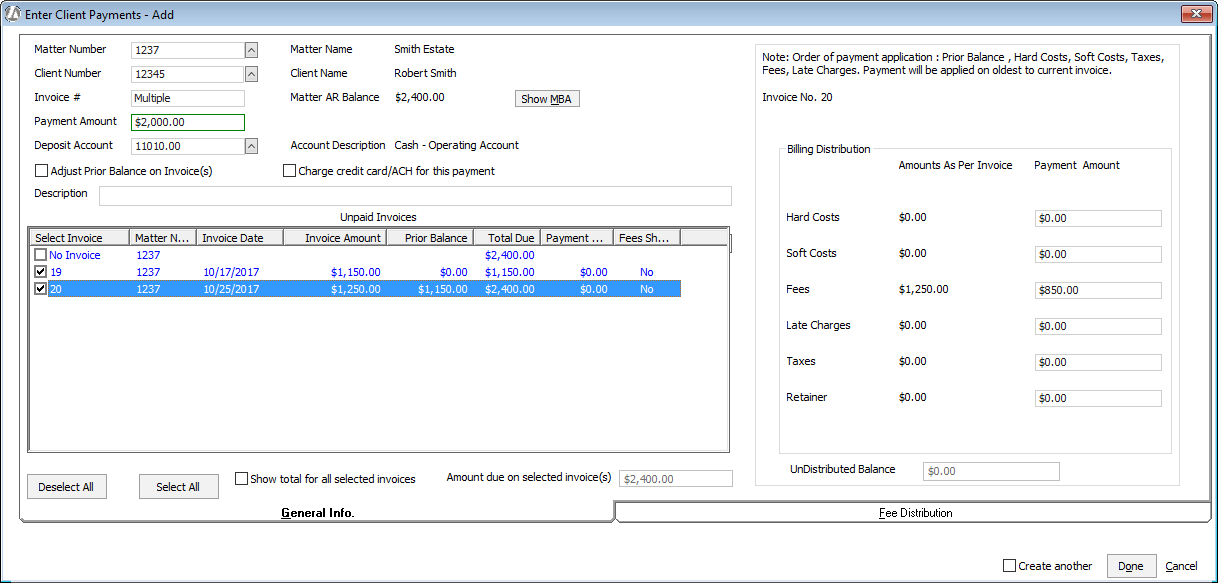

To know how the payment will be distributed

to each invoice, uncheck Show total

for all selected invoices. Then, highlight the invoice line

item to see how the payment will be applied to that invoice. Edit

these amounts as desired.

For example, assume that the payment of $2,000 is being applied to

invoice 19 ($1,150.00) and invoice 20 ($1,250.00). To find out how

the payment will be applied to each invoice, uncheck Show

total for all selected invoices. Highlight invoice

19 to see that it will be paid in full ($1,150.00):

Then, highlight invoice 20 to see that the remainder of the payment

($2,000.00 - $1,150.00 = $850.00) will be applied:

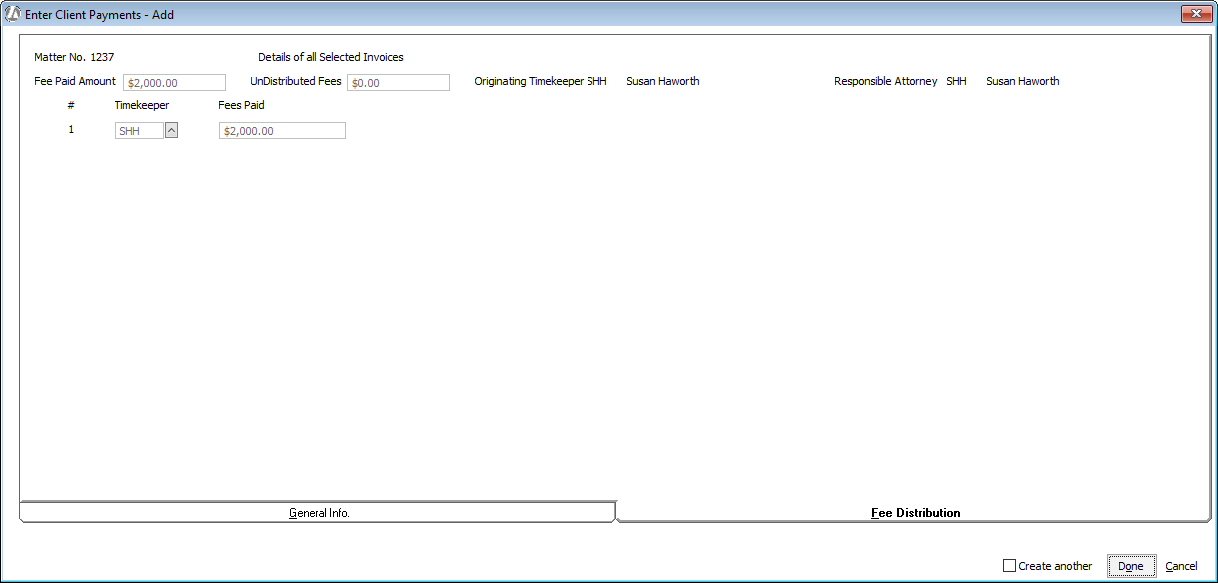

Select the Fee

Distribution tab. This tab is used to enter information about

how the fees portion of the payment is to be distributed amongst the

timekeepers. The fee is distributed to timekeepers in the proportion

of total fee due and total fee received for each selected invoice.

NOTE: If you entered retainer fees in the breakout fields, use a dummy

timekeeper (like RET) to receive the retainer funds. This way you

don’t have to guess which timekeeper will work against the retainer.

After the work has been done, make a negative deposit against the

RET timekeeper. Then, enter a deposit for the correct timekeepers.

This will redistribute the retainer funds so that the correct people

are credited for the work.

Change the fee distribution amounts as necessary. To add more timekeepers

click Add Timekeeper. You

can add up to 35 timekeepers. NOTE: When multiple invoices are selected

for the payment, you can only make changes to fee distribution if

Show total for all selected invoices

is unchecked and an invoice is highlighted on the General

Info tab.

UnDistributed Fees must be zero (0)

before you will be able to save the client payment.

Click Done.

The client payment is listed in the Enter Client Payments window. Post the client payment. NOTE: Don’t forget to post your client payment or it won’t appear in the matter billing activity!