Do one of the following:

-

Select Billing > Payments Received. The Enter Client Payments window appears. Click Add.

-

Click the Enter Client Payments toolbar button.

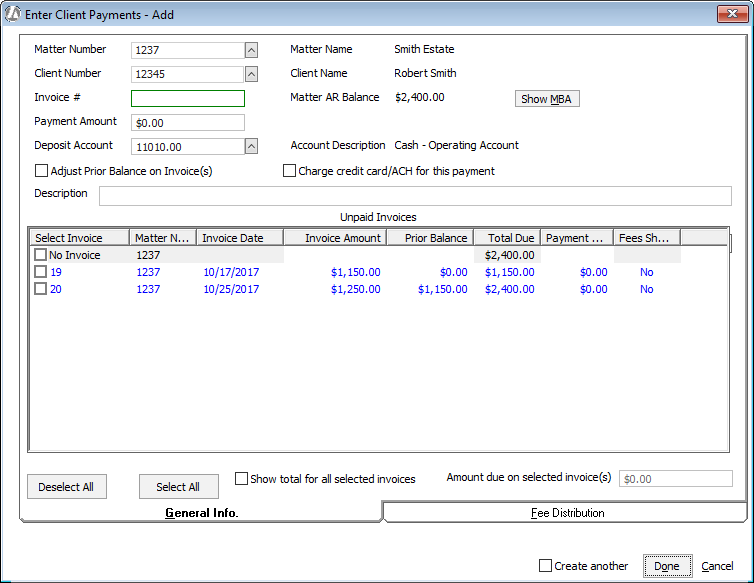

The Enter Client Payments - Add window opens. Select the matter for Matter Number. All unpaid invoices for the selected matter are listed in the Unpaid Invoices section. When Matter Number is selected, Client Number auto-populates.

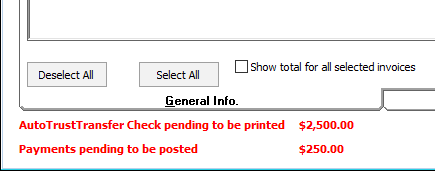

After the matter is selected, make note of any warnings that might be listed in the lower left corner of the window. You might need to cancel this transaction and correct for the warning. Warnings will appear if there are any auto trust transfer checks pending to be printed for the selected matter or if there are any pending client payments pending to be posted for the selected matter.

(optional) If you are applying the payment to one invoice and you know the invoice number, you can enter it in the Invoice # field. Notice that when you enter an invoice number it is automatically checked in the Unpaid Invoices section.

Enter the amount of the client payment in the Payment Amount field. (If this is a negative client payment, enter a minus sign in front of the amount.)

Enter the account number to which the payment is to be applied in the Deposit Account field. (Never use the trust account number!)

If needed, the following fields can provide more information:

-

Matter AR Balance: The amount that has been billed for the matter but not paid.

-

Show MBA: Click to view all billed and unbilled activity for the matter. Note that this total amount will not necessarily equal the Matter AR Balance amount.

When Adjust Prior Balance on Invoice(s) is checked, payments will be applied to invoices’ prior balance first, in first-in, first-out (FIFO) order. When not checked, payments will be applied to the current invoice, and users will have to select more invoices if the payment is greater than the invoice’s balance. NOTE: This option is checked by default if Apply Payments against Prior Balance first is checked in Company Preferences.

Check Charge credit card/ACH for this payment to make the client payment using the credit card or ACH account added for the client. If a credit card/ACH account has not been set up for the client, a form appears and you can set up payment information for the client.

Enter the description of the client payment in the Description field.

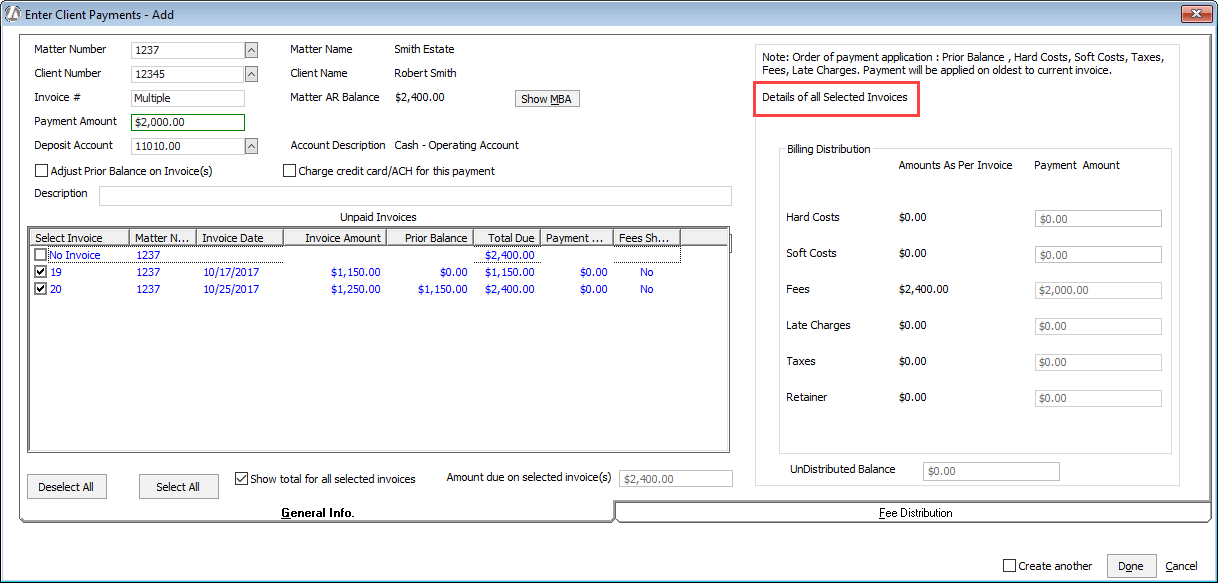

The Unpaid Invoices section lists all unpaid invoices for the selected matter. Unpaid invoices are listed in the order of invoice date, from the oldest (top of list) to newest (bottom of list). You must check one of these line items in this section. Notice that when you check one of these line items, payment breakout information appears on the right side of the window.

The payment is broken out based on your initial selection of invoices, starting with the oldest invoice and going in the order of Hard Costs, Soft Costs, Taxes, Fees, Retainers and Late Charges. If you deselect an invoice and select another invoice, the payment is not distributed again by Abacus Accounting. You are responsible for making the appropriate changes. However, you can deselect all invoices and then select the correct invoices for payment, and the application will distribute payment again.

-

If you do not want to apply the client payment to an invoice, check No Invoice. No invoice always equals Matter AR Balance.

-

If you want to apply the client payment to one invoice, check the invoice line item. The payment breakout shows that all of the payment is applied to the checked invoice.

-

If you want to apply the client payment to multiple invoices, check the invoice line items. The payment breakout shows that the payment is applied to the total of the checked invoices.

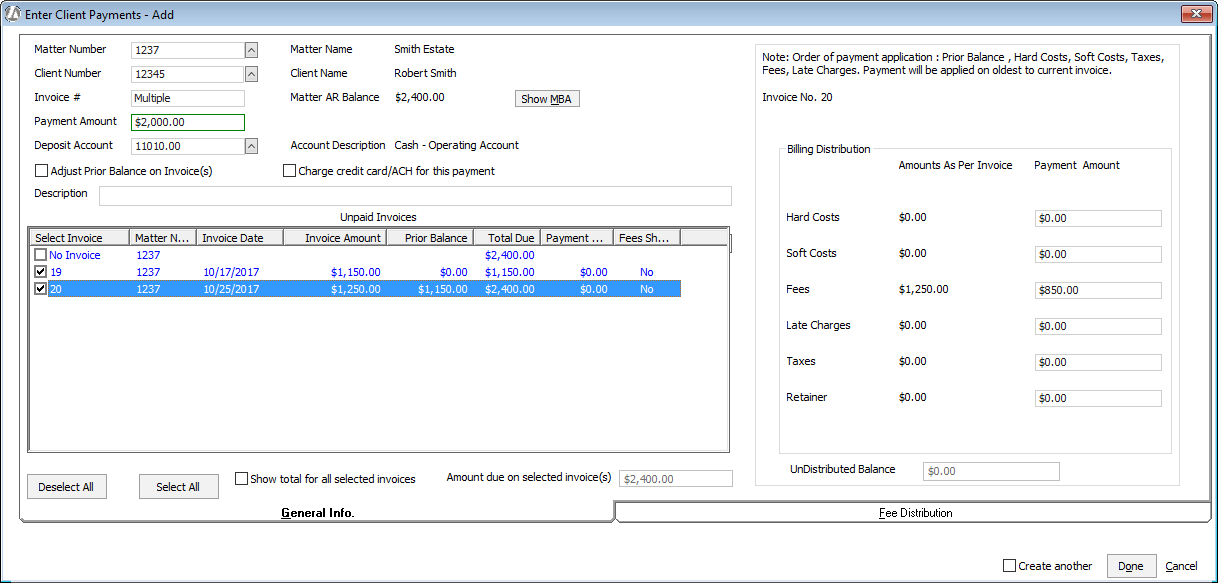

If you selected multiple invoices and you want to know how the payment will be distributed to each invoice, uncheck Show total for all selected invoices. Then, highlight the invoice line item to see how the payment will be applied to that invoice. Edit these amounts as desired.

For example, assume that the payment of $2,000 is being applied to invoice 19 ($1,150.00) and invoice 20 ($1,250.00). To find out how the payment will be applied to each invoice, uncheck Show total for all selected invoices. Highlight invoice 19 to see that it will be paid in full ($1,150.00):

Then, highlight invoice 20 to see that the remainder of the payment ($2,000.00 - $1,150.00 = $850.00) will be applied:

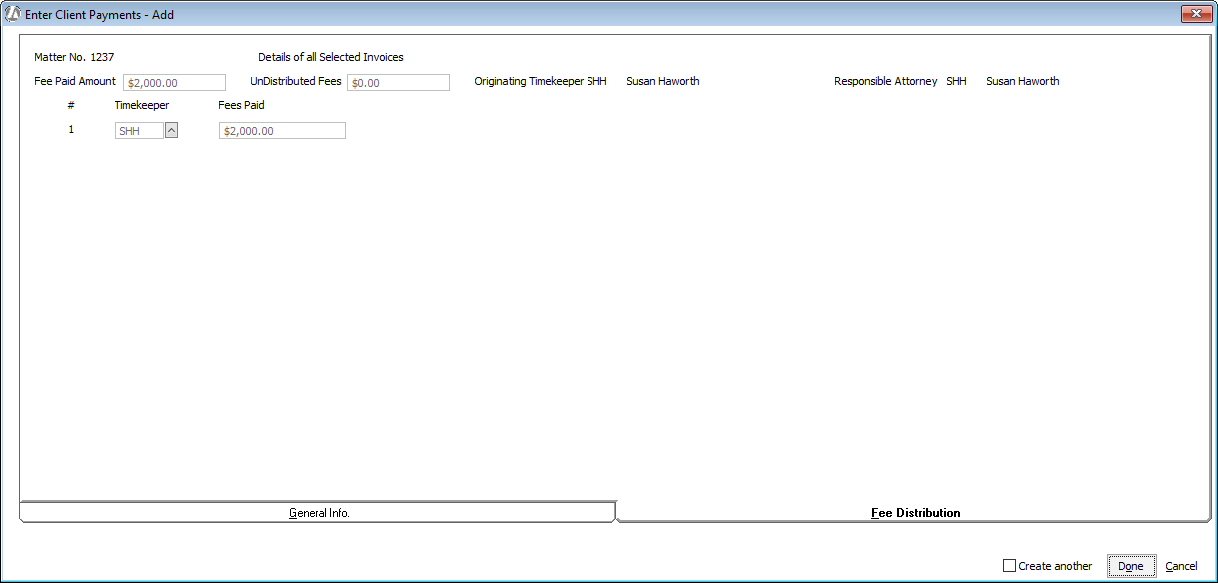

Select the Fee Distribution tab. This tab is used to enter information about how the fees portion of the payment is to be distributed amongst the timekeepers. The fee is distributed to timekeepers in the proportion of total fee due and total fee received for each selected invoice. However, if No Invoice was selected, then the total fee will be attributed to the responsible timekeeper of the selected matter.

NOTE: If you entered retainer fees in the breakout fields, use a dummy timekeeper (like RET) to receive the retainer funds. This way you don’t have to guess which timekeeper will work against the retainer. After the work has been done, make a negative deposit against the RET timekeeper. Then, enter a deposit for the correct timekeepers. This will redistribute the retainer funds so that the correct people are credited for the work.

Change the fee distribution amounts as necessary. To add more timekeepers click Add Timekeeper. You can add up to 35 timekeepers. NOTE: When multiple invoices are selected for the payment, you can only make changes to fee distribution if Show total for all selected invoices is unchecked and an invoice is highlighted on the General Info tab.

UnDistributed Fees must be zero (0) before you will be able to save the client payment.

Click Done.

The client payment is listed in the Enter Client Payments window. Post the client payment. NOTE: Don’t forget to post your client payment or it won’t appear in the matter billing activity!